Cllr. Matthew Bennett, Labour Cabinet Member for Housing in Lambeth.

“We’d all like to live for free in million pound homes in Clapham”, Cllr. Matthew Bennett, Labour Cabinet Member for Housing in Lambeth, told Spectacle in a recent interview for our documentary about the eviction of residents from Rectory Gardens housing co-op. Yet, Spectacle’s film reveals that this statement, and numerous others Bennett made, is based on gross inaccuracies, calling into question the evidential basis for Lambeth’s decision to sell off the houses, a decision that Lambeth Labour MP Kate Hoey has told us “will go down in history as one of the worst the borough has made”.

Million pound homes?

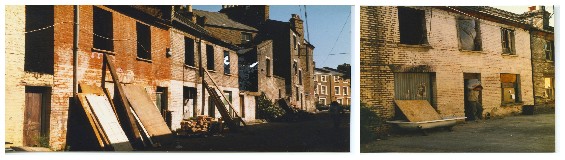

In the mid-1970s, Lambeth Council Compulsory Purchase Ordered the L-shaped street of 28 Victorian terraced houses in the heart of Clapham Old Town for as little as £2000 – £4000 each under ‘slum clearance’. Along with numerous other ‘shortlife’ homes CPOd in the borough, the properties were effectively abandoned due to lack of funds to do them up. The only work ever to be carried out by the council since was to deliberately damage many of the interiors in order to prevent occupation. But a few years on, as was common at the time, squatters found a way to move into what had become derelict houses. Realising that this was a way to help them maintain the properties, the council then decided to welcome them as ‘short-life tenants’. Similar events took place across the city. “The Council were even handing out keys. They didn’t seem to care at all that we were there; in fact they seemed happy about it”, said one resident. Forty years later, and Lambeth are one of the last London boroughs to deal with their shortlife portfolio, having dithered about for decades, during which time a whole community and way of life has flourished. But in 2011, in the context an over-inflated London property market and government cuts, the Council decided to sell off what have become people’s long-standing homes at auction to raise cash. Evictions are currently in process.

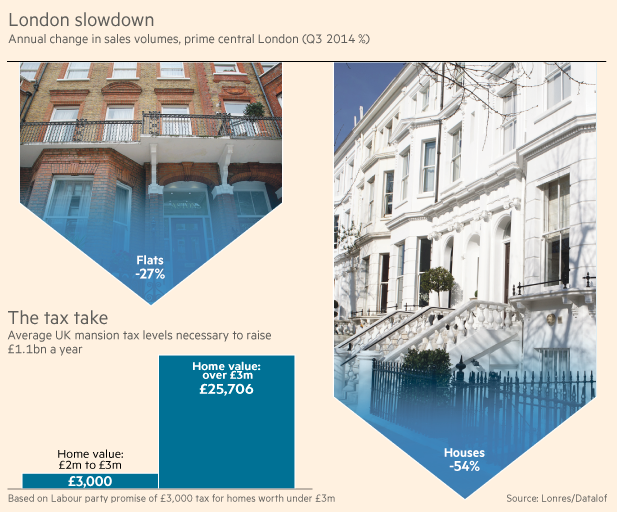

Yet, if Lambeth are hoping to make one million pounds each on these houses, they must be dreaming. So far they have made £56 million on the sale of around 120 ‘shortlife’ houses. That’s around £466,000 for each one. There are now only around 50 shortlife properties remaining in the borough, and the Council aims to sell off the last remaining homes by the end of 2015. Rectory Gardens represents most of this tail-end stock. But rather than one million, the average sale price for a co-op property at auction is half that. Both houses already sold on Rectory Gardens went for under £500,000. It is unclear how much Lambeth anticipate making on the sale of the remaining houses; Spectacle have requested a figure.

How is this money to be spent? In our interview, Bennett said decisively that the money would be used to “build 1000 new council homes”, yet, a few moments later, he made more general statements about money going into a “pot” to pay for “road refurbishments, new primary school places” and seemingly other unspecified public services. His predecessor, Pete Robbins, said that the money raised from sales of co-op homes would plug a gap in the funding the council received for housing repairs. The money raised seems to be covering a lot of bases that it cannot possibly stretch to. Freedom of Information requests submitted by Lambeth United Housing Co-op (LUHC), (a campaigning group set up to protest similar borough-wide evictions), to find out exactly how the money will be spent have been unanswered. Spectacle has requested information regarding exactly where the new houses will be built, by when, and how much the total build is expected to cost.

Not only are these funds not being ring-fenced for housing, but the current £56 million windfall does not take into account the £1.8m spent so far on staffing and legal costs of eviction, nor the unknown additional sums spent on surveyors, auctioneers, vacant property managers, for which information Lambeth Council recently blocked another freedom of information request by LUHC. Neither does it factor in the added costs of re-housing people, which LUHC have estimated to be between £6 – £13m, nor the unknown long-term social welfare bill of caring for now isolated elderly and disabled residents, who had found support and care within the co-op community on the street, something the council seems keen to support in theory through its health and wellbeing policies and ‘Connected Communities’ project, but clearly not in practice when the community is already in situ.

Living for free?

Furthermore, the Council seems to refuse to acknowledge that it is thanks to the hard work, resources and energy of residents alone that houses that they once abandoned are now lucrative cash cows. Rather than living “for free”, in 1982, the majority of residents who came to settle in the houses formed a self-supporting co-op. Members paid into a pot, from which money was used to purchase materials or support substantial renovation works. These were carried out through a process of skill and labour sharing. Indeed, Labour Councillors Nigel Haselden, Christopher Wellbelove and Helen O’Malley in 2007 campaigning leaflets said: “Some of these homes would not be standing if it was not for the work of the people living in them.” Two of these Councillors, Wellbelove and Haselden, once elected did a complete U-turn on their promise to ‘fight for the rights of residents to stay in their homes’, now supporting the current eviction policy (O’Malley was deselected). Cllr. Bennett claimed no knowledge of this.

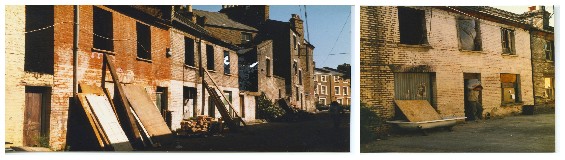

Correcting Bennett further on the matter of paying rent, he asked Spectacle to whom and how much were people paying. He then said “I heard it was no more than £1 a week. That’s almost nothing”, adding, as a different tack, “they’ve paid nothing to the Council”. First, the council never actually allowed any rent to be paid (more of which later), second, the actual membership fee was set at £5 a week (though rates varied across all co-ops), to reflect the low-income of those in the homes, all of whom were already on the council housing waiting list. This small fee was also designed to encourage residents to work on their own properties, which, contrary to Bennett’s claim that “people have not shown any willingness to spend the money necessary to bring [the houses] up to a decent condition”, they did, adding their own energy and labour. This included re-roofing, plastering, re-wiring, building new chimneys, installing windows and doors where there were none, putting new boilers into every house, building staircases, installing gas, and much more. Yet Bennett claims that “at least five properties are completely derelict” and that others have “fallen into disrepair” and “not been maintained”. He is clearly unaware, as he himself admitted during the interview, of the condition of the properties when they were initially purchased in the 1970s. Spectacle has sent him the below photographs to demonstrate the actual situation.

“Million pound” homes? The derelict condition of CPOd houses on Rectory Gardens in the 1970s before the co-op took over renovations.

In addition, Spectacle pointed out that since the residents have been paying council tax for years, according to the Valuation Office for England and Wales this legally qualifies them as ‘dwellings’ suitable for habitation, hence they could not possibly be “derelict”. A spate of recent articles concerning one property on the street said to have a tree growing through an illegal extension with dangerous electric wiring, rented out to sub-letters, is not a house that is part of the co-operative, yet it is being used to tarnish the community. Filming in a number of co-op homes, Spectacle found them to be comfortable, homely and safe. Having referred to a couple of other incidents with some houses in the street during his interview, Spectacle made the point to Bennett that crime is a social problem, not the fault of one set of people, neither should the actions of one mar the whole community, be that Rectory Gardens or ‘shortlife’ co-ops in Lambeth generally. He was unable to comment further.

Moreover, the idea that we should measure people’s contribution to society based on ‘how much they pay’ in monetary terms – (to the Council, in this case) – implied by Bennett’s statement, demonstrates an indefensible attitude of income-based prejudice. Looked at in entirely different way, the residents of Rectory Gardens have collectively done as much, if not more, to contribute to their community as many other rent-paying citizens do to theirs, and have a stable community that is not reflected by some of the highly transient ‘neighbourhoods’ that surround the street where occupants regularly move on and private rentals stay empty for long periods. The self-proclaimed ‘cooperative council’ should be falling over itself to recognise and reward those who voluntarily invest into making their ‘patch’ a positive place. Residents of Rectory Gardens have been behind numerous artistic and community-based initiatives in the area over the years, such as Cafe on the Common, the Tea Rooms, Studio Voltaire, and even the skate park on Clapham Common, activities which no doubt contributed hugely to making the area a now-desirable postcode, propping up the very market prices that Lambeth seek to capitalise on today.

There Is No Alternative?

Adding further insult to injury, despite the accusation of ‘living for free’, paying rent to the council was never given as an option. At no point since the establishment of the housing co-op have Lambeth Council sought any financial arrangements with residents. Bennett’s version of history is that “Other co-operatives took the opportunity to charge social rents and take a regularised position… Rectory Gardens did not go down the route [of] becoming a proper cooperative… We’ve spoken with the housing co-op on many, many occasions about ways in which they might want to finance taking their over as a co-op on their own, they haven’t been able to work with the money.” In fact, Rectory Gardens was not allowed to go down this route of ‘rationalisation’ and the council has never seemed to want to make them tenants – something that Tulse Hill Labour Councillor Mary Atkins said should have happened years ago. The Council has had opportunities of resolving the situation numerous times over the years, but has stopped deals going through, deciding not to come to a resolution and consistently using the threat of legal action as a first port of call. For example, the community embarked on years of without-prejudice negotiations with housing association Metropolitan Housing Trust and the Council, involving a lot of time, effort and money for the deal to evaporate because the council revalued the site.

On three occasions between 2012 and 2013, Lambeth United Housing Co-operative proposed to the council that residents begin to pay rent and become social housing tenants as a solution. They also came up with the idea of the ‘Super Co-op’, a proposal backed by housing experts that would see ex-council stock being recycled and refurbished by a borough-wide umbrella co-op while simultaneously skilling up local people. These solutions were rejected without being fully discussed. The Council even refused payment of their own legal charge, developed in-house; a so-called ‘use and occupation’ back fee seemingly designed to coerce people from the properties. A judge suggested a defendant pay in installments but Lambeth promptly declined this, presumably worrying that accepting payment could mean a case for tenancy rights in court.

As part of the eviction process, residents have been offered priority re-housing via the council’s Choice-Based Lettings system. Yet some of those that have accepted and found re-housing have reported damp, mould and asbestos, among other problems, not to mention the psychological difficulty of being forcibly displaced away from their community. Residents wish to remain in their homes, where they have raised families and built a robust community, and would be happy to pay council rents rather than needlessly displacing others on an already overburdened council housing waiting list. Yet Bennett argues that selling off this rare social housing stock will help the “21,000 people on our housing waiting list, the 1800 families in temporary accommodation and the 1300 living in severely overcrowded homes” because it is “not affordable” to spend money refurbishing them, money that could go towards new homes, or road refurbs, or primary school places… New council homes are of course welcomed, but should this be at the expense of existing council stock?

To top this off, at no point have residents asked the Council to spend money on the homes; rather they have proposed that they would take this on themselves via the Super Co-op. Bennett adds “It costs five times as much (£60 – £70,000) to refurbish a house on Rectory Gardens as it does to refurbish an existing council home.” Uncertain where these figures have come from, Spectacle have asked for the data used to make this claim. We have also written to Bennett to suggest that there are other options. The Super Co-op was one, but housing expert, and Director of Self-Help Housing, Jon Fitzmaurice has also told us he “continually comes up against large organisations who say it is uneconomic to do up houses but it is erroneous to take that view, as communities and small charities can make things happen for much less.” In Liverpool, a recent case he came across, saw a commercial builder estimate that a property would cost £30,000 to refurbish. It was finally done by a community group for £6,000, with the labour provided by co-op members and the only costs those of materials, a surveyor and building supervisor. Surely, as a ‘co-operative council’, Lambeth is aware that the co-operative way is often one of the most affordable and socially productive around. A bit more imagination, a bit less short-termism, might work wonders.

Pursuing the eviction policy, one of the worst outcomes would be, as housing expert Jon Fitzmaurice told us, that properties are ‘flipped’ and the council end up renting the properties back off a private landlord for social housing, which would be expensive, wasteful and self-destructive, as the eviction policy is already proving to be. Over in Southwark, campaigners have found that similar council promises to build ‘new’ ‘council’ homes, on closer inspection, have resulted in the selling off of public assets to purchase private land and build houses that are only partially available for social rents, the remainder being offered for private sale or shared ownership. Without a firm and open statement from the Council on exactly where the money is going, it is difficult to hold such promises to account.

Meanwhile, residents of Rectory Gardens are on the move, or in court, with some spending maybe one last Christmas in their self-created homes.

To read more of our blogs about Rectory Gardens, click here.

Spectacle homepage

Like Spectacle Documentaries on Facebook

Follow SpectacleMedia on Twitter